With a trip in progress or after its completion, the traveler must account for expenses to the company.

Every trip, regardless of whether or not there is an advance, automatically generates a record in the Accountability routine (FINA677) linked to it.

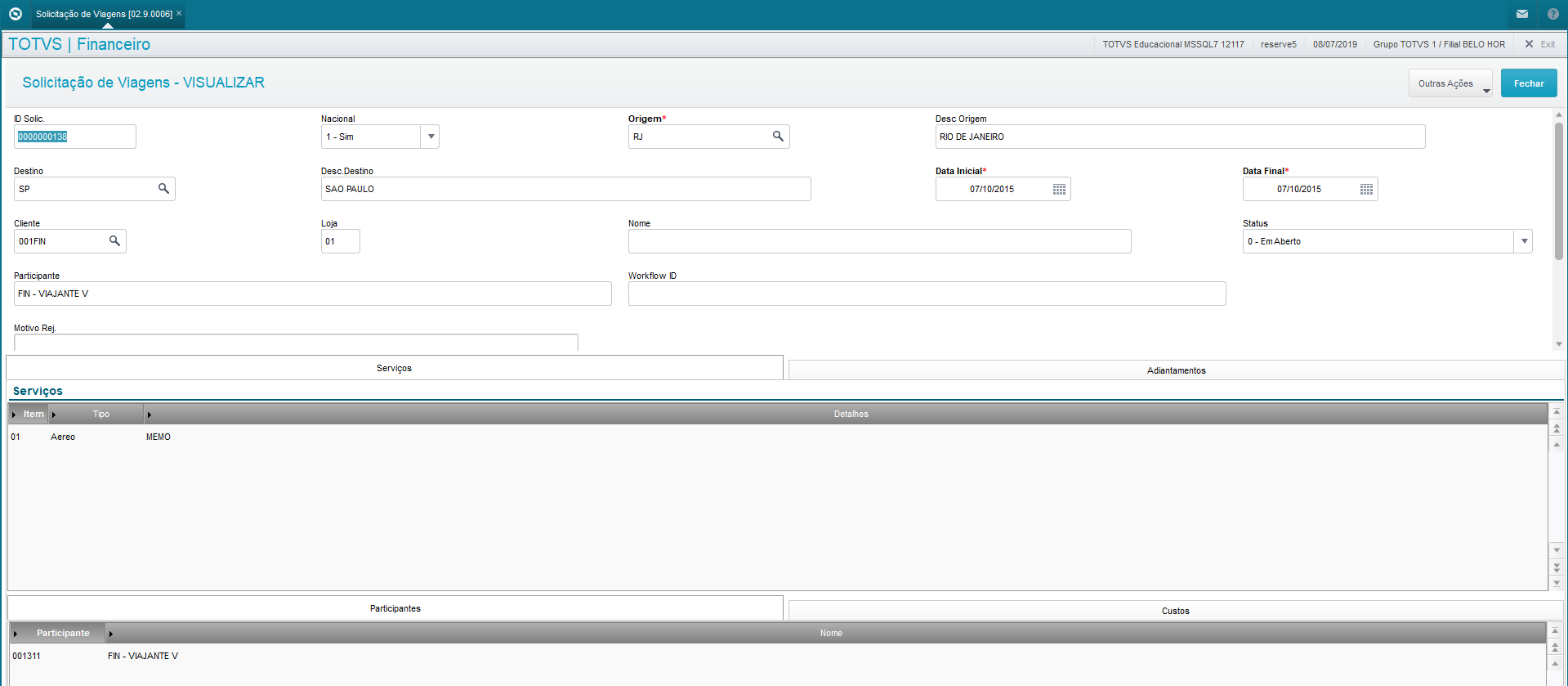

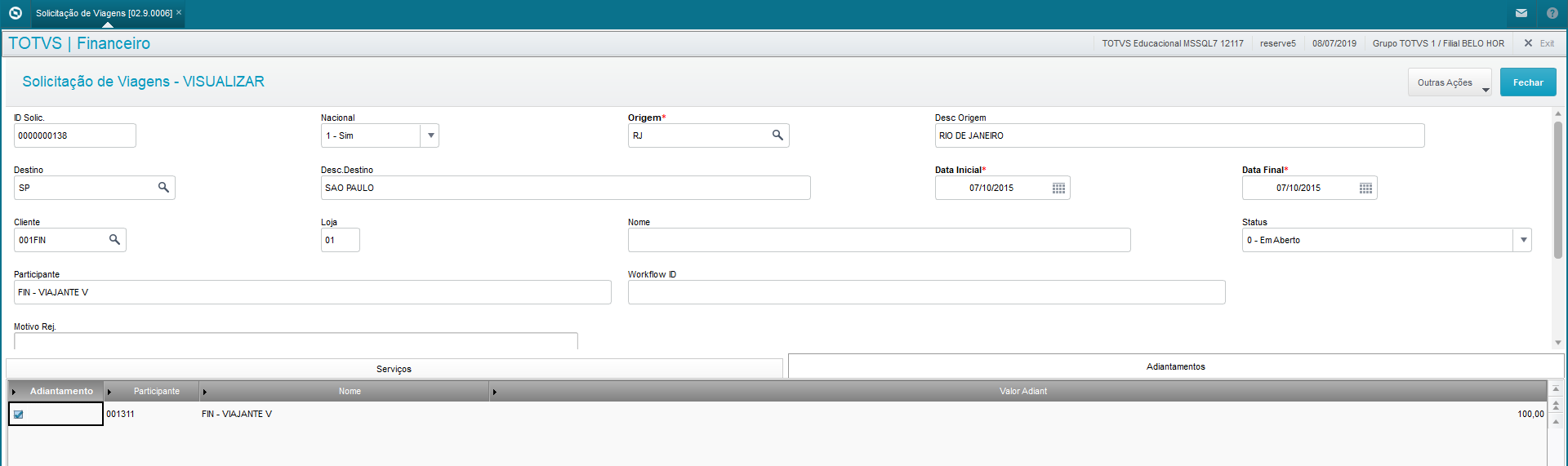

A rendering of accounts has the basic data of a trip, such as its number, start and end dates, location, the customer that was served (if applicable), in addition to the cost entities and percentage of billing against the customer (if applicable), etc.

The employee may inform their expenses item by item, informing: expense, location, amount (in local currency or other and its conversion rate), quantity, cost entities, etc.

In addition, advances are listed on accountability and deducted from the total amount at the bottom of accountability.

The amounts spent, refundable, and the balance are also shown at the bottom, in the 3 currencies used by Protheus: local, dollar and euro.

Once finalized and forwarded to the travel department (after its inclusion or at a later time by the option to send to be checked), the travel department will check the accountability. Although the system already calculates the reimbursable amounts of expenses using the expense limit rule, if the verifier identifies an item in the statements that are outside the travel policy, they can post the discounts at this time and the amount to be returned/refunded is updated.

If the approval and/or release steps for financial are active, pending issues will be generated for the superior of the traveler and for the financial/travel department, respectively.

Example:

In the event that the whole process must pass through approval or verification, we have:

If any step can be performed automatically, we have:

Finally, in addition to the trips, the routine also allows individual rendering of accounts.